Protect your family with a Personal Risk Plan

A personal Insurance Plan provides peace of mind in case of an unforeseen event. It provides a financial benefit in the event of serious injury, illness or death.

Trauma cover

Trauma Insurance provides a lump sum benefit in the event you are diagnosed with a serious medical condition such as cancer, heart attack or stroke.

Health Insurance & Cancer Care

Health Insurance covers the costs for specialists, tests and surgical cover in a private hospital.

Cancer care can be added on separately to cover the entire cost of cancer treatment in a private hospital.

Mortgage & Income Protection

Mortgage & Income Protection Insurance is an Insurance policy designed to pay off your mortgage or cover your day to day bills on a monthly basis in the event you are unable to work due to illness or injury. We can calculate enough funds to repay the loan repayments, rates and insurances and expenses monthly based on what you earn.

Permanent Disability cover

Total & Permanent Disability covers sickness or injury if a person is unable to work permanently in their own or any occupation for which they are suited by training, education, or experience.

Life Insurance

Life Insurance is a lump sum benefit that pays out to the surviving family, funds to cover such things as remaining mortgage and funeral costs. This provides your family or spouse peace of mind knowing they can move on financially after loosing a loved one.

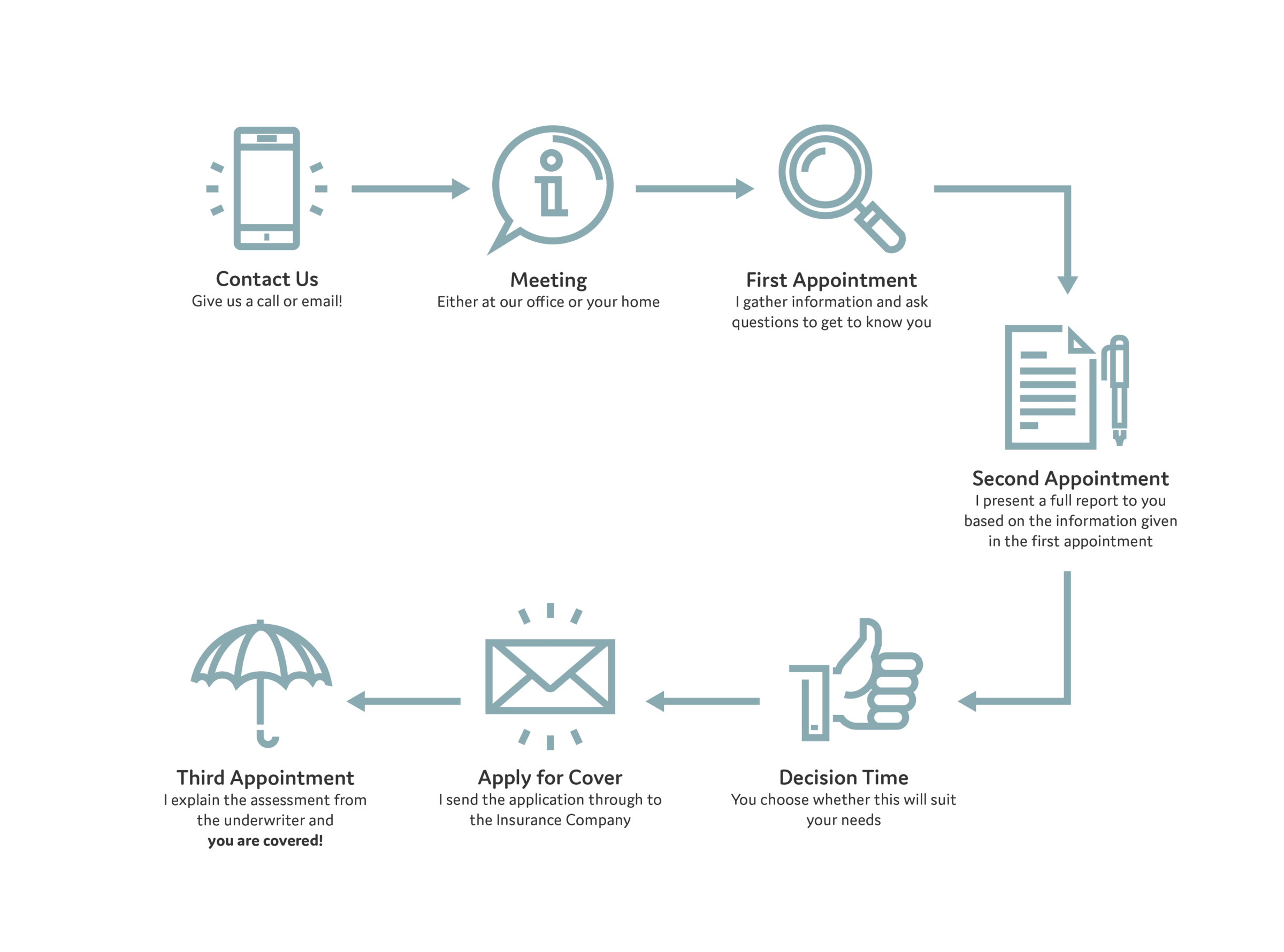

The Process of Personal Cover

Annette makes sure the decision making and process is as painless as possible. She takes care of all the hard work and so you don't have to.